IMARC Group has recently released a new research study titled “U.S. Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Logistics Market Overview

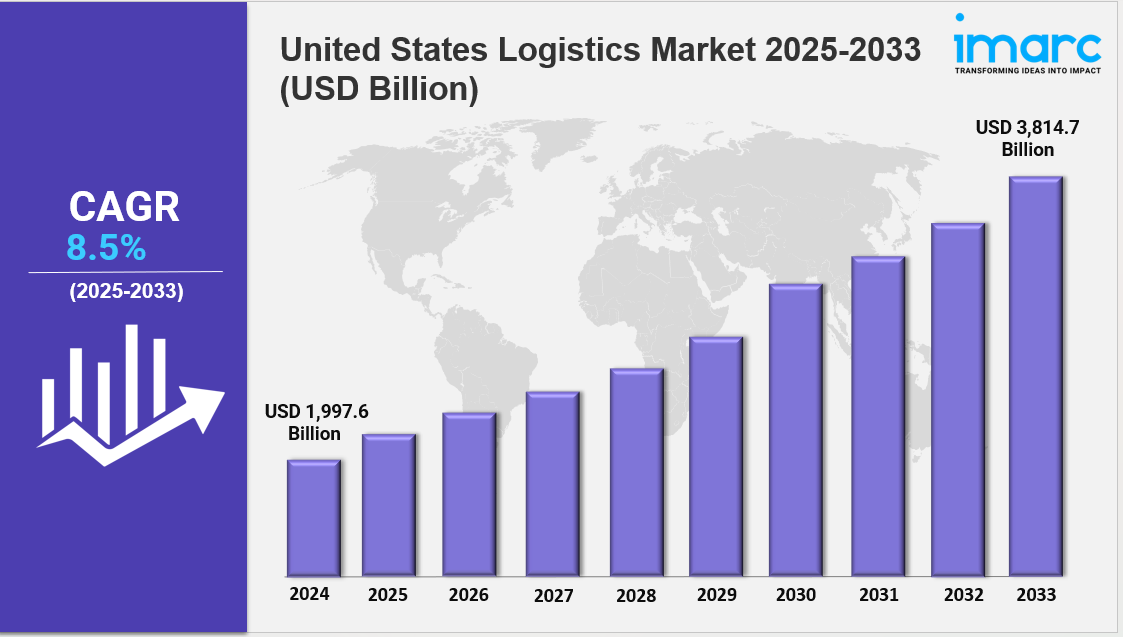

The U.S. logistics market size is anticipated to reach USD 1,997.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3,814.7 Billion by 2033, exhibiting a CAGR of 8.5% from 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1,997.6 Billion

Market Forecast in 2033: USD 3,814.7 Billion

Market Growth Rate 2025-2033: 8.5%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-logistics-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by booming e-commerce and increasing demand for fast, efficient delivery services

✔️ Rising adoption of automation, robotics, and real-time tracking across supply chain operations

✔️ Expanding investments in warehouse infrastructure and green logistics to enhance capacity and sustainability

United States Logistics Market Trends

The United States logistics market is undergoing a period of rapid transformation, driven by the continued rise of e-commerce, infrastructure investments, and evolving regulatory frameworks. Parcel volumes have surpassed 25 billion annually, reflecting record-high United States logistics market demand. Consumers increasingly expect faster delivery, prompting major retailers such as Amazon and Walmart to optimize last-mile operations and reduce delivery times by nearly 18% since 2024.

Technology and Supply Chain Modernization

Technology is at the center of this transformation. Drone deliveries, supported by expanded FAA approvals, have now exceeded 1.2 million successful shipments across 15 states. Autonomous trucking solutions from companies like TuSimple and Aurora handle roughly 8% of interstate freight, improving safety and efficiency. In cities, micro-fulfillment centers and dark stores continue to expand, with over 4,300 facilities enabling nearly three-quarters of online grocery orders to be fulfilled in under 90 minutes.

Challenges and Cost Pressures

Despite impressive growth, the industry faces rising operational costs. Higher fuel prices and a 14% increase in reverse logistics volume are putting pressure on margins. To counter this, logistics providers are investing in robotic sorting systems, blockchain tracking, and AI-driven optimization to improve accuracy and reduce expenses. Since the pandemic, more than $47 billion has been invested to strengthen supply chains, while manufacturers pursue “China+2” sourcing strategies to diversify production.

Government policies such as the CHIPS Act and the Inflation Reduction Act have boosted demand for just-in-time logistics, while cross-border trade with Mexico continues to surge — truck crossings at the Laredo port now exceed 18,000 per day.

Sustainability Becomes a Core Priority

Sustainability is increasingly shaping the United States logistics market outlook. The EPA’s Clean Freight Strategies rule requires 30% of heavy-duty trucks to transition to zero-emission models by 2030, driving more than $12 billion in investments in electric and hydrogen fleets.

Shipping and rail companies are moving toward cleaner operations, including methanol-fueled vessels and hydrogen-powered locomotives, while air freight operators are expanding their use of sustainable aviation fuel (SAF), now making up 12% of total consumption. The demand for specialized logistics is also rising, particularly for handling materials associated with lithium and rare earth mining, key to the clean energy transition.

Workforce and Infrastructure Shifts

Labor shortages remain a critical challenge, with around 78,000 trucking positions unfilled as of 2024. In response, logistics companies are testing autonomous vehicles and adopting digital twin technologies to better prepare for supply chain disruptions, including port congestion and extreme weather events.

Retailers are also rethinking fulfillment strategies — Target, for example, now fulfills nearly half of its online orders directly from stores, improving speed and efficiency. Smaller businesses are benefiting from logistics-as-a-service (LaaS) platforms, gaining access to advanced warehousing, tracking, and analytics capabilities that were once limited to large enterprises.

Global Trade and Cybersecurity Risks

Global trade routes are evolving as well. The 2024 Panama Canal drought forced about 19% of Asia-to-East Coast shipments to be rerouted through the Suez Canal, altering traditional supply patterns. At the same time, cybersecurity threats are increasing — ransomware attacks targeting logistics providers rose by over 200% in the past year. As a result, companies are adopting blockchain-based contracts and real-time monitoring systems to strengthen data protection and operational resilience.

Conclusion: United States Logistics Market Outlook

The United States logistics market share is being reshaped by technological innovation, sustainability commitments, global trade realignments, and workforce challenges. According to the latest United States logistics market report, the outlook remains positive, with significant opportunities for growth. However, long-term success will depend on managing cost pressures, investing in digital transformation, and building flexible, resilient supply chains to support continued United States logistics market growth in a changing global environment.

United States Logistics Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Analysis by Model Type:

- 2 PL

- 3 PL

- 4 PL

Analysis by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Analysis by End Use :

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Regional Analysis:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302